Explain Different Methods of Capital Budgeting

The discounted cash flow method includes the NPV method profitability index method and IRR. Both the traditional methods of capital budgeting do not consider time value of money.

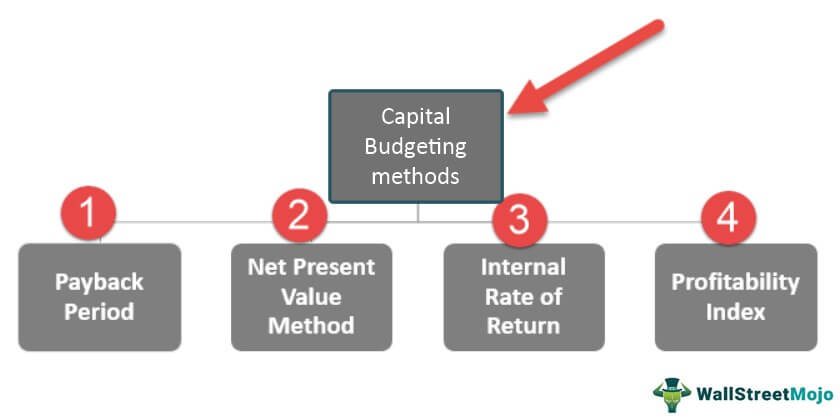

Capital Budgeting Methods Overiew Of Top 4 Method Of Capital Budgeting

The methods of evaluations are classified as follows.

. There are many considerations taken for investment decision process such as environment and economic conditions. Four Main Types of BudgetsBudgeting Methods. A company may add capacity to its existing product lines to expand existing.

As a rule of thumb when a project has a profitability index over 1 it will likely be a worthwhile investment. Traditional Methods of Capital Budgeting are Payback Period Method Post Payback Period Method and. Business firm is confronted with alternative investment proposals.

Traditional Methods of Capital Budgeting. There are different methods adopted for capital budgeting. For example the planning programming approach see section 43 can be clearly seen as underpinning the decision-making function.

2 Replacement and Modernization -. Accounting rate of return ARR ARR is another capital budgeting accounting method that compares a projects expected average revenue to how much money the organization invested to make it all happen. 1 incremental 2 activity-based 3 value proposition and 4 zero-based.

It is more refined from both a mathematical and time-value-of-money point of view than either the payback period or discounted payback period methods. Net Present Value NPV. Net present value NPV The net present value capital budgeting method measures how profitable you can expect a project to be.

The funds available are always living funds. Iii The results of NPV method and IRR method may differ when the projects under evaluation differ in their size life and timings of cash flows. The main objective of modernization and replacement is to improve operating.

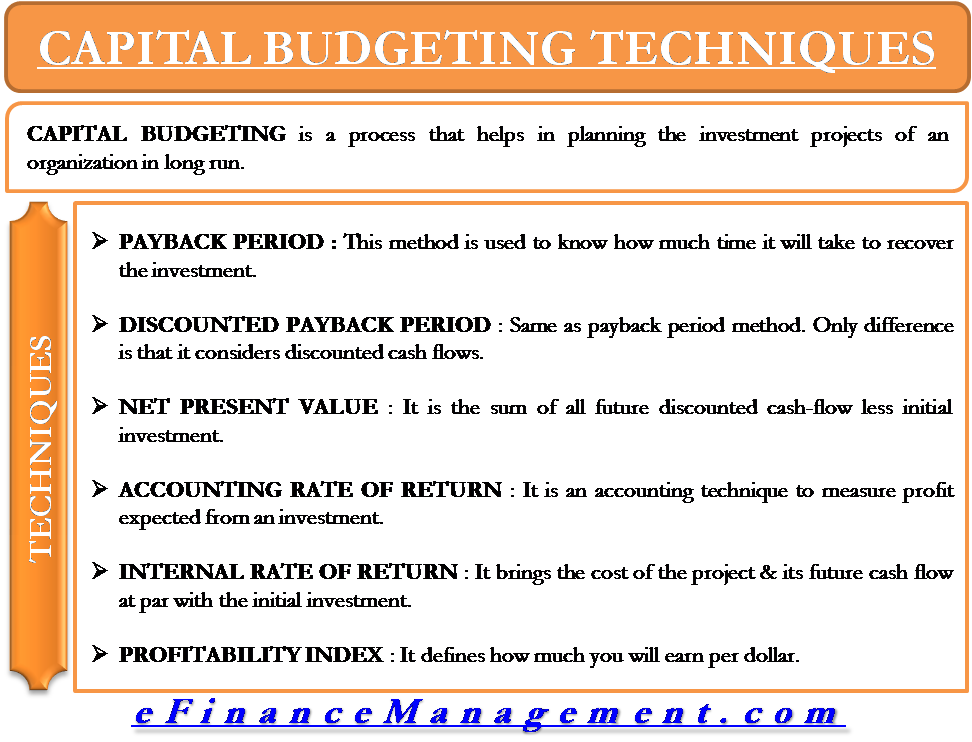

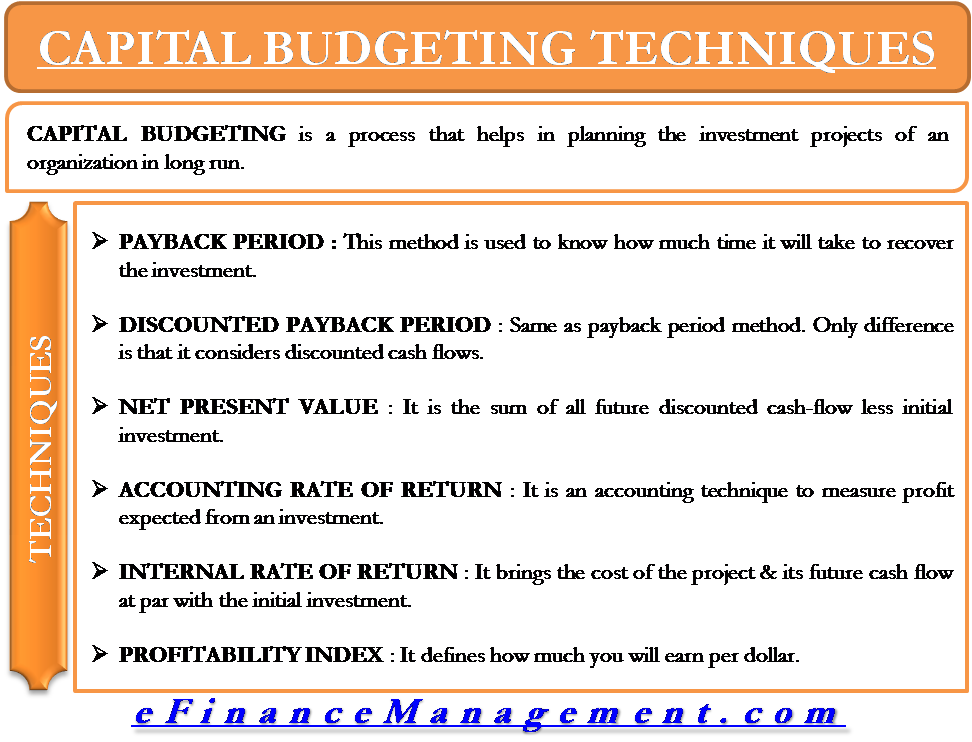

Capital budgeting methods seek to assess the return on investment of the various alternatives with the goal of making a decision to proceed with one or more projects. Techniques of Capital Budgeting. The payback method and accounting rate of return method discussed under traditional methods of capital budgeting suffer from many shortcomings.

Payback period and Accounting rate of return method. Capital Budgeting Discounted Method 3. The payback period PB internal rate of return IRR and net present value NPV methods are the most common approaches to project selection.

CAPITAL BUDGETING TECHNIQUES METHODS. Profitability index PI. Payback method does not consider all cash flows associated with a project.

Decision is taken on the basis of equality of present value of all cash flows to present value of cash outflows. Types of Capital Budgeting - 1 Expansion and Diversification -. The process through which different projects are evaluated is known as capital budgeting.

It is also more insightful in. Conversely one of the criticisms of the incremental approach is that it does not allow for. The 3 main capital budgeting methods are.

Recognition of time value of money- In internal rate of return method present values of all cash inflows are computed. 3 Mutually Exclusive Investments -. Following are the important techniques of capital budgeting.

The major methods of capital budgeting include discounted cash flow payback and throughput analyses. Ii mutually exclusive decisions. Different budgeting methodologies allow the budget to perform these roles in different ways and to differing extents.

Methods of capital budgeting are mainly divided into two categories- traditional and modern methods. Internal rate of return method of capital budgeting has following merits. Internal rate of return IRR 3.

It involves firms decisions to invest its current funds for addition disposition modification and replacement of fixed assets. In this sense Net Present Value method seems to be better as it assumes that the earnings are reinvested at the rate of firms cost of capital. Although an ideal capital budgeting solution is such.

I The accept-reject decisions. METHODS OF CAPITAL BUDGETING OF EVALUATION. Internal rate of return.

Along with the methods we will also talk about the capital budgeting techniques advantages and disadvantages. By using this method capital funds are allocated by estimating the length of time required for the cash earnings on a given investment to return the original cost to the owner. Generally the business firms are confronted with three types of capital budgeting decisions.

Capital budgeting is the firms formal process for the acquisition and investment of capital. The traditional methods or non discount methods include. If the proposal is accepted the firm incur the investment and not otherwise.

Capital budgeting is mathematical in nature which means that there are certain techniques related to quantitative investment and are employed to determine the worth of an opportunity of investment. When using this. By matching the available resources and projects it can be invested.

Companies often use net present value as a capital budgeting method because its perhaps the most insightful and useful method to evaluate whether to invest in a new capital project. The payback criterion is perhaps the most widely used method of capital budgeting. There are four common types of budgets that companies use.

These four budgeting methods each have their own advantages and disadvantages which will be discussed in more detail in this guide. Discounted cash flow methods. Capital budgeting technique is the companys process of analyzing the decision of investmentprojects by taking into account the investment to be made and expenditure to be incurred and maximizing the profit by considering following factors like availability of funds the economic value of the project taxation capital return and accounting methods.

Iii capital rationing decisions.

Capital Budgeting Techniques With An Example Meaning Example

Capital Budgeting Techniques Importance And Example

What Are Capital Budgeting Techniques Definition And Meaning Business Jargons

No comments for "Explain Different Methods of Capital Budgeting"

Post a Comment